OpenAI Instant Checkout is a one-click payment flow that shortens purchase time and boosts conversions, integrate it with your site to reduce friction, secure payments, and measure lift with A/B testing.

Introduction

OpenAI Instant Checkout is the subject here, and this post is informational with practical, step-by-step guidance so you can implement a fast, secure payment flow and fix on-page issues like low CTR titles and weak meta descriptions. You’ll get a clear workflow, copy-paste code, metadata tips that improve clicks, and a compliance checklist. I mention related entities like payment gateways and conversion optimization tools early because they matter when you integrate any instant checkout solution.

In my experience, the small changes in checkout copy and the right metadata often yield the biggest lift, so I’ll give you exact prompts, headline patterns, and the technical scaffolding you need to ship fast. Read on to get a ready-to-publish article, and use the code samples as a starting point.

What openai instant checkout is and why it matters

OpenAI Instant Checkout refers to a streamlined checkout experience that minimizes steps, pre-fills known buyer data, and lets customers complete purchases with a single confirmed action. Whether labeled "instant checkout" or "one-click pay," the goal is the same, reduce friction and increase conversions.

How instant checkout works

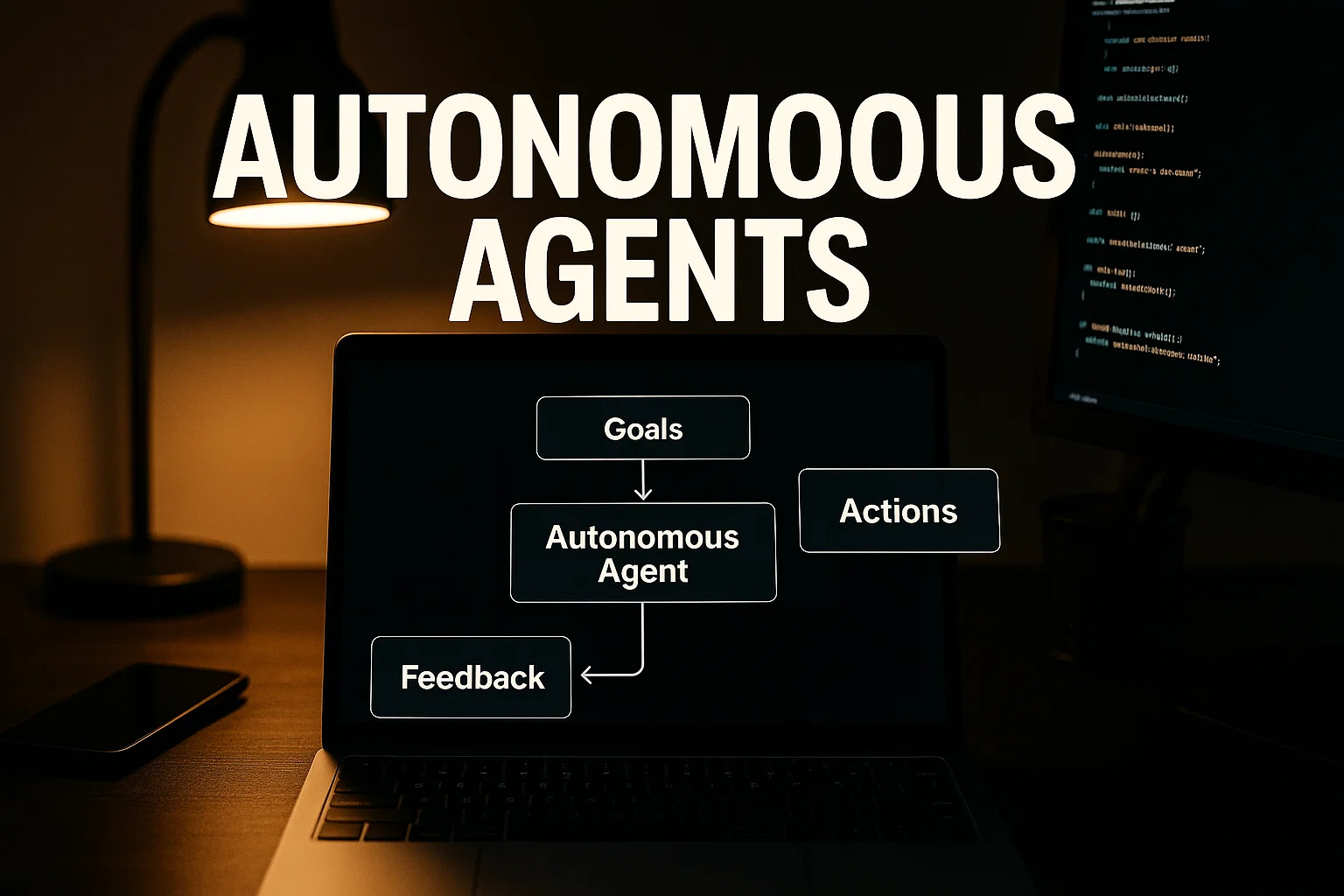

At a high level, the flow stores a secure payment token, uses a minimal UX surface, and performs risk checks server-side. The system orchestrates authentication, payment authorization, and confirmation in a few calls, then returns a receipt and analytics event for measurement.

Background and industry context

Ecommerce and SaaS teams chase quicker checkout flows because every extra form field or distraction increases abandonment. Combining a one-click experience with clear messaging, trust signals, and optimized metadata can lift CTR and conversions together. Integrations with established payment gateways and identity providers keep the process secure while letting you focus on UX.

Why it matters to you

If you sell subscriptions, digital goods, or services, a faster checkout directly impacts revenue. You’ll reduce cart abandonment, improve user satisfaction, and gain cleaner analytics to iterate on pricing and messaging. Implementing instant checkout also gives you an opportunity to fix low-CTR titles and meta descriptions across product pages, which improves both search visibility and click performance.

How to implement openai instant checkout — step-by-step

This section shows a practical implementation path, plus a code example you can adapt.

- Define the user flow and constraints. Decide which pages can use instant checkout, what user data is stored, and what actions require re-authentication.

- Choose payment and identity providers. Pick a PCI-compliant processor, tokenization support, and if needed, a secondary fraud detection layer.

- Implement a server-side token vault. Never store raw card details client-side. Store tokens and use short-lived session keys for the client.

- Build the minimal client UI. A single button labeled with clear benefit and price works best, show trust signals and a concise policy link.

- Add monitoring and fallbacks. Send analytics events for success, failure, and manual review; provide a classic checkout fallback.

- A/B test title and meta variants. Test different high-CTR headlines, meta descriptions, and button copy to find what resonates.

Client-to-server Node.js example

// node.js

// Minimal server endpoint to create an instant checkout session

// Replace placeholders with your payment provider and secure keys

const express = require("express");

const fetch = require("node-fetch");

const app = express();

app.use(express.json());

app.post("/create-checkout", async (req, res) => {

try {

const { productId, userId } = req.body;

// 1. Lookup product and calculate total

// 2. Create a payment intent or session on the server side

const response = await fetch("https://payments.example.com/create-session", {

method: "POST",

headers: {

"Authorization": `Bearer ${process.env.PAYMENT_KEY}`,

"Content-Type": "application/json"

},

body: JSON.stringify({ productId, userId, instant: true })

});

const session = await response.json();

// 3. Return a short-lived client token for the front end

res.json({ clientToken: session.clientToken });

} catch (err) {

console.error("Checkout creation failed", err);

res.status(500).json({ error: "Could not create checkout session" });

}

});

app.listen(3000);

Explanation: This sample shows server-side session creation, use secure keys via environment variables, and never expose raw payment credentials to the client.

Client-side quick call (browser)

// javascript

// Use the client token to display a one-click flow

async function startInstantCheckout(productId) {

const resp = await fetch("/create-checkout", {

method: "POST",

headers: { "Content-Type": "application/json" },

body: JSON.stringify({ productId, userId: "currentUser" })

});

const { clientToken } = await resp.json();

// Use clientToken with your payment SDK to complete payment

paymentSDK.payWithToken(clientToken);

}

Explanation: The client requests a short-lived token and calls the payment SDK, which handles secure confirmation and redirects.

Best practices, recommended tools, pros and cons

Follow these best practices to protect users and improve conversions.

Best practices

- Use concise, benefit-first button copy like "Buy in 1 Click, Secure".

- Show clear price and refund policy near the button.

- Require explicit consent for saved payment details, and provide easy manage payment controls.

Recommended tools

- Payment gateway with tokenization

- Pros: PCI scope reduction, secure tokens, broad support, Cons: fees and vendor lock-in.

- Install/start tip: enable tokenization in the dashboard and test in sandbox.

- Fraud and risk service

- Pros: reduces chargebacks, provides signals for high-risk transactions, Cons: adds latency and cost.

- Install/start tip: integrate risk API server-side and configure thresholds.

- A/B testing and analytics platform

- Pros: measure CTR and revenue lift, set experiments, Cons: adds instrumentation work.

- Install/start tip: add event tags for instant checkout clicks and conversions.

One-line tips: always test in production-like sandbox, measure the full funnel, and iterate.

Challenges, legal and ethical considerations, troubleshooting

Instant checkout speeds purchases, but you must design for safety and compliance.

Common challenges

- Unexpected charges: users may accidentally authorize payments, avoid by requiring clear consent.

- Regulatory rules: local laws can affect saved payment methods and consent workflows.

- False positives in fraud systems: balance risk controls to avoid blocking valid purchases.

Compliance checklist

- Obtain explicit consent for saved payment methods, store audit logs, and provide easy opt-out.

- Use PCI-compliant processors and tokenization to avoid storing raw card data.

- Publish clear terms, refund policy, and privacy notice linked at checkout.

- Keep prompt and model versions if you use automated messaging or AI-driven upsells for auditability.

Alternatives and troubleshooting

If instant checkout causes disputes, switch to a two-step confirmation, require authentication for high value purchases, or offer a one-time use token instead of stored payments. Recreate failing flows locally using logs and reduce complexity by removing optional upsells on first iteration.

Search quality advice recommends prioritizing user intent and trust signals to improve clickthrough and conversion rates, focusing on clear titles and transparent policies. (Google)

Content quality and testing is foundational, combine human review with experiments to measure actual user behavior. (Moz)

Conclusion and CTA

OpenAI Instant Checkout can shorten purchase time and increase conversions when implemented with clear UX, secure tokenization, and proper compliance. Start with a small, instrumented rollout, A/B test metadata and button copy, and monitor for fraud and disputes. Optimize for clarity, speed, and trust, and you’ll see measurable revenue gains.

Welcome to Alamcer, a tech-focused platform created to share practical knowledge, free resources, and bot templates. Our goal is to make technology simple, accessible, and useful for everyone. We provide free knowledge articles and guides in technology, offer ready-to-use bot templates for automation and productivity, and deliver insights to help developers, freelancers, and businesses. For custom development services for bots and websites, contact Alamcer.

Key takeaways:

- Reduce friction with a secure one-click flow.

- A/B test titles and meta to boost CTR.

- Use tokenization and clear consent to reduce risk.

- Instrument every event for measurable iteration.

Helpful resources: Google guidelines for helpful content, Moz on content quality, SEMrush on CRO and keywords, OpenAI official docs.

FAQs

What is openai instant checkout?

OpenAI Instant Checkout is a streamlined one-click payment flow concept that minimizes steps, uses secure tokenization, and completes purchases quickly while keeping user consent and compliance in view.

How does instant checkout improve conversions?

By reducing form fields and friction, instant checkout shortens the path to purchase, lowers abandonment, and increases the likelihood of a completed sale, especially on mobile.

Is openai instant checkout secure?

It can be secure if you use PCI-compliant payment processors, tokenization, server-side verification, and fraud monitoring, plus explicit consent for saved payment details.

Do I need PCI compliance for instant checkout?

Yes, any system that handles payments must follow PCI requirements, use tokenization to limit exposure, and work with compliant payment providers.

How should I write the checkout button copy?

Use concise benefit-led copy like "Buy in 1 Click, Secure", include price context, and test variants to find the best CTR.

Can I A/B test Instant Checkout easily?

Yes, add event tracking for impressions, clicks, and conversions, and run controlled experiments to measure lift in checkout success and revenue.

What if a user disputes an instant payment?

Provide clear receipts, easy refund paths, and logs of consent and session tokens. Use your payment provider’s dispute tools to manage chargebacks.

Which analytics should I track?

Track clickthru rate on the instant checkout button, conversion rate, refund rate, chargebacks, and time-to-purchase metrics to measure impact.

Are there privacy concerns with saved payment data?

Yes, store minimal user data, use tokenization, publish a transparent privacy policy, and follow consent laws like GDPR or CCPA where applicable.

How do I get help building an instant checkout?

For custom integration, templates, or development help, contact Alamcer for tailored services and ready-to-use bot templates.

Compliance and disclaimer

This content is for informational purposes and not legal or financial advice. Follow payment processor terms, privacy laws, and data protection regulations, and consult a legal or compliance professional if you have jurisdictional questions.